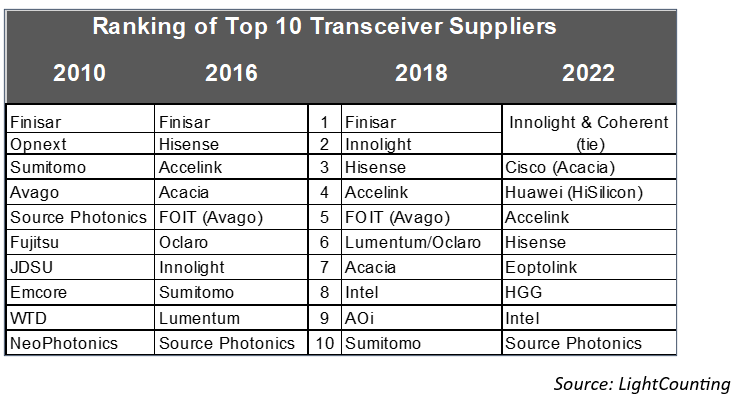

Recently, LightCounting, a well-known market organization in the fiber optical communication industry, announced the latest version of the 2022 global optical transceiver TOP10 list.

The list shows that the stronger the Chinese optical transceiver manufacturers, the stronger they are. A total of 7 companies are shortlisted, and only 3 overseas companies are on the list.

According to the list, Chinese fiber optical transceiver manufacturers were only shortlisted in 2010 by Wuhan Telecom Devices Co., Ltd. (WTD, later merged with Accelink Technology); in 2016, Hisense Broadband and Accelink Technology were shortlisted; in 2018, only Hisense Broadband, Two Accelink Technologies were shortlisted.

In 2022, InnoLight (ranked tied for 1st), Huawei (ranked 4th), Accelink Technology (ranked 5th), Hisense Broadband (ranked 6th), Xinyisheng (ranked 7th), Huagong Zhengyuan (ranked 7th) No. 8), Source Photonics (No. 10) were shortlisted. It is worth mentioning that Source Photonics was acquired by a Chinese company, so it is already a Chinese optical module manufacturer in this issue.

The remaining 3 places are reserved for Coherent (acquired by Finisar), Cisco (acquired by Acacia) and Intel. Last year, LightCounting changed the statistical rules that excluded optical modules manufactured by equipment suppliers from the analysis, so equipment suppliers such as Huawei and Cisco were also included in the list.

LightCounting pointed out that in 2022, InnoLight, Coherent, Cisco, and Huawei will occupy more than 50% of the global optical module market share, of which InnoLight and Coherent will each earn nearly US$1.4 billion in revenue.

Given the huge resources of Cisco and Huawei in the field of network systems, they are expected to become the new leaders in the optical module market. Among them, Huawei is the leading supplier of 200G CFP2 coherent DWDM modules. Cisco’s business benefited from the shipment of the first batch of 400ZR/ZR+ optical modules.

Both Accelink Technology and Hisense Broadband‘s optical module revenue will exceed US$600 million in 2022. Xinyisheng and Huagong Zhengyuan are the successful cases of Chinese Fiber optical transceiver manufacturers in recent years. By selling optical modules to cloud computing companies, their rankings have risen to the top 10 in the world.

Broadcom (acquired Avago) fell out of the list in this issue, and will still rank sixth in the world in 2021.

LightCounting said that optical transceiver are not a priority business for Broadcom, including Intel, but both companies are developing co-packaged optical devices.

Post time: Jun-02-2023